The 1-2-3 reversal pattern is a common chart formation that can be used in Forex, stock and futures trading alike. This strategy is deemed to have a strong revenue potential. Many traders use it to determine the precise trade entry and exit points.

This formation scheme is of a general-purpose type and can be applied to all currency pairs on relatively long timeframes. You can put the 1-2-3 reversal pattern approach to test in any of Forex.game contests. Below see the key elements of the strategy in question.

The 1-2-3 pattern strategy is a pattern used to trade market reversals. Reversals are an integral part of the market and after a currency pair has had a prolonged move in a particular trend, it is expected that a market reversal will occur, usually as a result of profit taking or a complete reversal of the trend caused by traders pushing prices in the opposite direction.

The hallmark of the 1-2-3 reversal strategy is to identify the 1-2-3 reversal pattern on the charts and identify a strategy of trading this pattern.

There are two questions that arise:

- How can a trader recognize a reversal once it is in motion?

- How can one trade that reversal for profits?

These two questions are what the 1-2-3 reversal strategy seek to answer.

Identification and Recognition of the 1-2-3 Reversal Pattern

The first step is to identify and recognize the reversal pattern that is moving in a 1-2-3 format. Recognition of this pattern starts with reading the charts to be able to identify the pattern. Most Forex trading platforms today have in-built charting programs. You can therefore use the MetaTrader 4 charts for your pattern analysis and identification.

So how is the recognition of the 1-2-3 pattern done? The first step is to open a 4-hour or a daily chart in order to analyze the price movements on those charts. This is because the long term charts are a better reflection of the overall trend of the market.

Short term charts such as the hourly charts only indicate the intra-day price movements in the market, and this is akin to market noise.

What may look like a trend reversal on the short term charts may actually just be a very brief retracement on the long term charts. What we want to trade is a true market reversal and so it is necessary to conduct all analyses on the long term charts.

Due to the fact that the market is a bi-directional market, the 1-2-3 reversal strategy can be traded as a reversal of the uptrend, or a reversal of the downtrend.

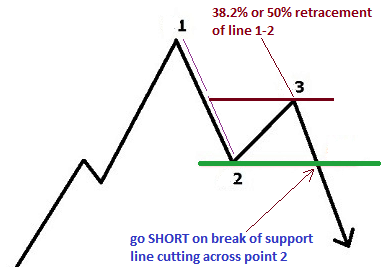

- If the trader wants to trade the 1-2-3 reversal strategy as an uptrend reversal, the aim is to initiate a short trade. This snapshot below indicates how the price movement on the charts would look like. We would have the uptrend topping out at point 1, followed by price reversing downwards to find an area of support at point 2. From the area marked point 2, price is expected to move up to an area which corresponds to the 38.2% or 50% retracement of a line drawn from point 1 to point 2, eventually stopping at a resistance level which is lower than point 1 marked point 3. From this area marked as point 3, price is expected to make a full reversal to the downside, breaching the point 2 support line.

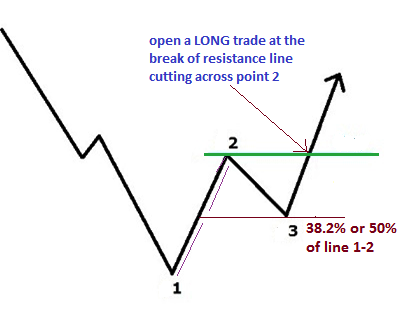

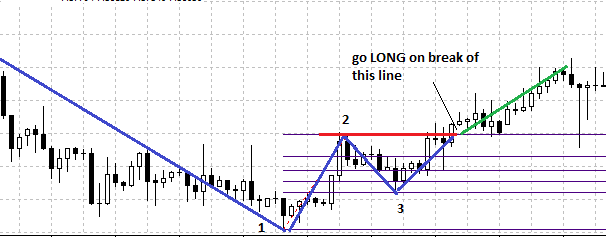

- For the corresponding 1-2-3 reversal trade after a downtrend, the price action is expected to bottom out at point 1, after which it makes a brief push to the upside to a resistance area at point 2. From point 2, the price action makes a downward move and halts at either 38.2% or 50% retracement are of a line drawn from point 1 to 2, eventually stopping at a support area which is higher than point 1, known as point 3. From the area known as point 3, price is expected to make an upward reversal, taking out the point 2 resistance. This is illustrated below:

So identification of the 1-2-3 reversal setup requires an understanding of these points:

- You need a trend line tool to draw the line from point 1 to 2.

- You need the Fibonacci retracement tool to identify the 38.2% or 50% retracement of a line drawn from point 1 to 2, which is lower than point 1 in an uptrend and higher than point 1 in a downtrend.

- The retracement level is point 3.

Understanding the extent of retracement will therefore aid the trader as to where the entry for the reversal trades will be made.

Trade Entry and Exit

Once the identification of the pattern has been done, the trader can then proceed to initiate trades with the strategy. The most important points of the trade strategy can be summarized as follows:

- Knowing where to set your trade entries

- Knowing when to exit the trade.

Short Trade

The short trade is for a downside reversal of the 1-2-3 pattern that has formed after the uptrend has ended. The key point is to be sure that the 1-2-3 pattern has formed, and then to trade with confirmation.

This involves allowing the 1-2-3 pattern to be formed, and then to trade at the break of the support line which cuts across point 2 as shown:

Take a look at the snapshot. Point 3 is at the 50% retracement level of line 1-2, and the short trade is made at the break of the support at line 2. The break is determined by when a candle closes below the blue line 2 support line. The Stop Loss is set above the broken support, and Take Profit is set to at least two times the stop loss distance.

Long Trade

Allow points 1,2 and 3 to form on the chart as shown below. Mark a horizontal line across the point 2 resistance. Go Long when the price has broken this resistance line.

A break of the resistance means that the candle in view has closed above the resistance line. If the candle closes high above this line, allow a brief pullback to the broken resistance and enter long at that line.

This can also be achieved using a Buy Limit order, set after the candle has closed above the resistance.

The Stop Loss is set below the broken resistance, and Take Profit is set to at least two times the stop loss distance.

Open a Demo Account to test the 1-2-3 reversal pattern strategy in ForexCup competitions and win real-money prizes. Learn how to participate here.